Please join our Taxand professionals from around the world, as we gather in Paris for Taxand’s Transfer Pricing Conference 2024. Here we will share the latest developments impacting cross-border business operations.

This dynamic event promises to provide practical insights to address ever-changing business opportunities, as well as the chance to directly interact with your transfer pricing peers.

Conference Venue: L’Apostrophe, 83 Avenue Marceau, 75008 Paris.

Our welcome reception will take place from 7pm on Wednesday 24 January at Le Fouquet’s, 97/99 avenue des Champs Elysées 75008 Paris. Coffee will be available from 8.30am and the conference begins at 9.15am on Thursday 25 January at L‘Apostrophe, closing with a networking reception from 6pm.

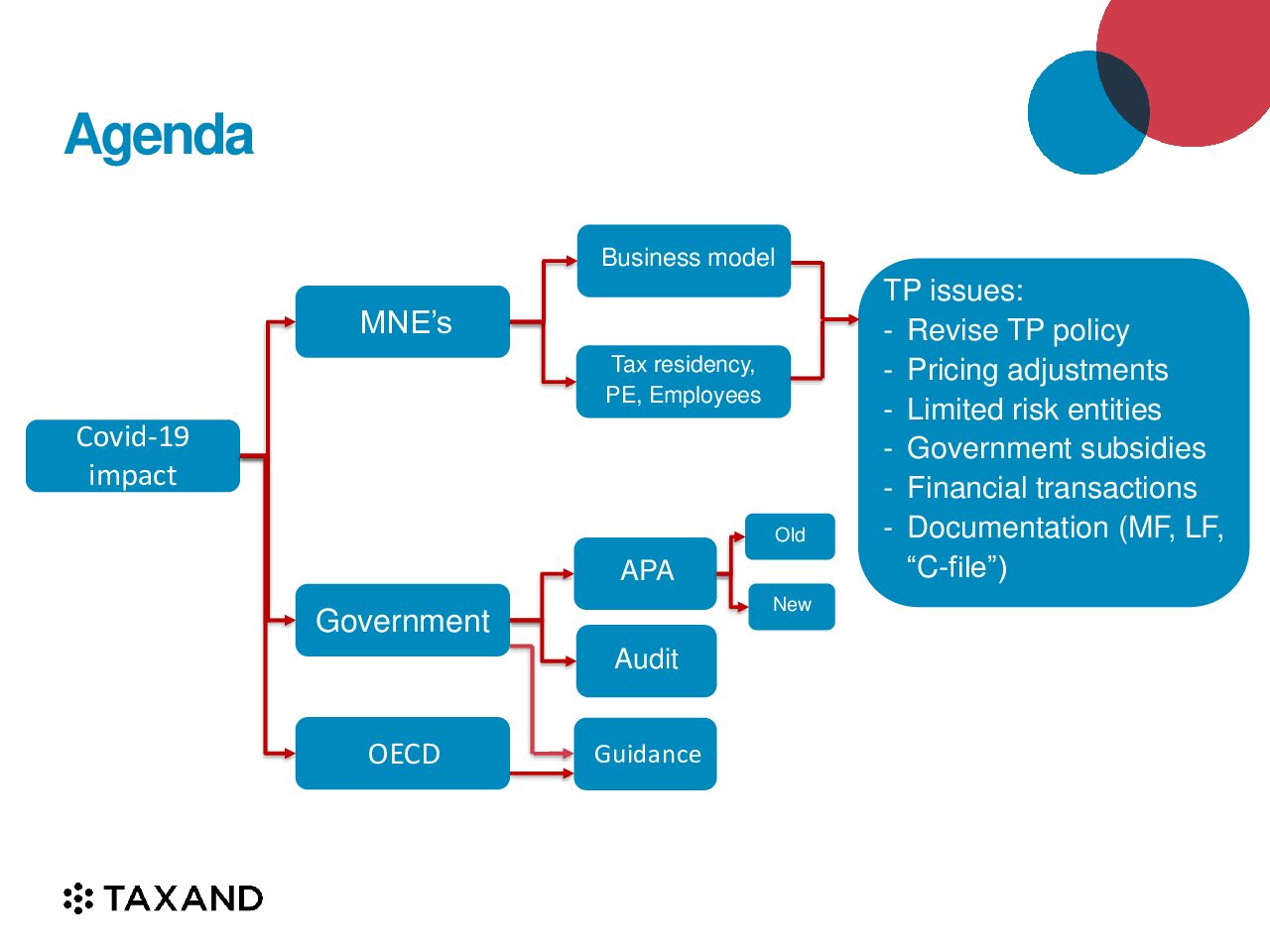

Our varied agenda will feature interactive sessions on a range of transfer pricing topics, including:

- Special Guest Economist : Anne-Laure Delatte

- OECD Pillars, Let’s Go!

- Global Mobility & Transfer Pricing Impact

- Inhouse Transfer Pricing Practice and Next Generation Leaders in Transfer Pricing

- Transfer Pricing Adjustments.

We look forward to welcoming client guest speakers to share the stage with our international Taxand experts.

We hope you can join us!