Traditiegetrouw wordt op Prinsjesdag het Belastingplan gepresenteerd. Vanzelfsprekend bevat het Belastingplan ook voorstellen die relevant zijn voor de vastgoedsector. Susan Raaijmakers, vastgoedfiscalist en partner bij Taxand, bespreekt in deze bijdrage de recente ontwikkelingen.

Om te beginnen bevat het Belastingplan geen grote verrassingen en liggen de genomen maatregelen in lijn der verwachting. De meeste van de fiscale maatregelen die in het Belastingplan 2024 zijn opgenomen waren al eerder aangekondigd in de Voorjaarsnota. Vanwege de demissionaire status van het kabinet was het dit jaar namelijk niet zozeer de vraag of er nog een spreekwoordelijk konijn uit de hoge hoed zou komen, maar vooral of bepaalde voorstellen door zouden worden geschoven. Daarnaast is het altijd nog even spannend om te zien hoe de voorstellen uiteindelijk zijn uitgewerkt.

In de fiscale wereld is de afgelopen periode met name veel gespeculeerd over het al dan niet invoeren van het overgangsrecht voor bepaalde voorstellen en de voorwaarden waaronder dat overgangsrecht dan van toepassing zou zijn is de afgelopen periode veel gespeculeerd in de fiscale wereld. De verwachting was daarbij dat bepaalde overgangsrechtsregels alleen toegepast zou kunnen worden voor transacties of structuren die al voor Prinsjesdag zijn opgezet. Deze verwachting is grotendeels uitgekomen. Van diverse overgangsrechtregels kan alleen gebruik worden gemaakt indien vóór 19 september om 15:15 uur aan bepaalde voorwaarden is voldaan. Dit geldt bijvoorbeeld voor toepassing van de aandelenfusiefaciliteit voor FGR’s en CV’s, die per 1 januari 2025 niet langer Vpb-plichtig zijn.

Daarbij was het tot vandaag nog onzeker of het volledige pakket aan overgangsrechtsregels, waaronder regels voor de overdrachtsbelasting, ook voor de CV zouden gaan gelden. Voor het FGR waren die regels namelijk al aangekondigd, maar voor de CV nog niet. Ook op dit punt heeft het kabinet conform onze verwachting gehandeld: het overgangsrecht geldt ook voor de CV.

Uiteraard kunnen de wetsvoorstellen die nu zijn ingediend nog worden aangepast en moeten de voorstellen nog door de eerste en tweede kamer worden aangenomen. De verwachting is wel dat de hieronder genoemde wetvoorstellen volgens de aangegeven ingangsdata zullen worden aangenomen. De vastgoedgerelateerde wetsvoorstellen uit het Belastingplan 2024 worden onderstaand besproken.

Aanpassing vrijgestelde beleggingsinstelling (vbi) en fiscale beleggingsinstelling (fbi)

Het vbi/fbi regime wordt afgeschaft voor vennootschappen die rechtstreeks in Nederlands vastgoed beleggen. Vanaf 2025 zijn dergelijke vennootschappen op reguliere wijze vennootschapsbelasting verschuldigd. Het nu nog geldende tarief van 0% komt te vervallen.

Aanpassing Vpb-plicht fonds voor gemene rekening (FGR) en open commanditaire vennootschap (CV)

Open FGR’s en open-CV’s zijn op dit moment Vpb-plichtig, net als (bijvoorbeeld) een BV. Per 1 januari 2025 wordt dit gewijzigd. De Vpb-plicht vervalt voor de meeste FGR’s en voor alle CV’s. Deze worden hierdoor fiscaal transparant. Het vervallen van de belastingplicht kan leiden tot fiscale afrekening in de vennootschapsbelasting, inkomstenbelasting en overdrachtsbelasting.

Om negatieve effecten van de afschaffing te voorkomen wordt overgangsrecht voorgesteld. Kort gezegd biedt het overgangsrecht mogelijkheden om fiscaal afrekenen te voorkomen, bijvoorbeeld door het belang in het FGR of de CV middels een aandelenfusie onder te brengen in een BV. Het overgangsrecht staat in principe alleen open voor FGR’s en CV’s die vóór 19 september 2023, 15:15 uur zijn opgericht.

Aanpassing BOR en DSR voor verhuurd vastgoed

Bij het schenken of nalaten van ondernemingsvermogen kan onder voorwaarden gebruik worden gemaakt van de bedrijfsopvolgingsregeling (BOR). Hierdoor wordt de heffing van schenk- of erfbelasting in veel gevallen beperkt. Daarnaast regelt de doorschuifregeling (DSR) dat onder voorwaarden geen inkomstenbelasting verschuldigd is bij bedrijfsoverdracht dan wel verkoop van aanmerkelijkbelangaandelen.

De genoemde regelingen staan alleen open voor ondernemingsvermogen. Beleggingsvermogen, zoals beleggingsvastgoed, is uitgesloten van deze regelingen. Voorgesteld wordt om:

- per 1 januari 2024 aan derden verhuurd vastgoed en vastgoed dat ter beschikking wordt gesteld per definitie als beleggingsvermogen aan te merken.

- per 1 januari 2025 de grens voor de 100% vrijstelling (BOR) te verhogen tot € 1,5 miljoen (nu: € 1,2 miljoen); en

- de vrijstelling voor het vermogen boven € 1,5 miljoen te verlagen tot 70% (nu: 83%).

Afschrijvingsbeperking gebouwen in eigen gebruik voor de inkomstenbelasting

Afschrijving op gebouwen is beperkt tot de bodemwaarde. Indien de fiscale boekwaarde van een gebouw minder bedraagt dan de bodemwaarde, is afschrijven niet langer toegestaan. Voor de inkomstenbelasting (box 1), bedraagt de bodemwaarde voor gebouwen in eigen gebruik op dit moment 50% van de WOZ-waarde. Voorgesteld wordt om dit per 1 januari aan te passen naar 100% van de WOZ-waarde.

Door deze aanpassing worden de afschrijvingsregels voor de inkomstenbelasting gelijk getrokken met die voor de vennootschapsbelasting. Deze beperking is voor de vennootschapsbelasting namelijk al enkele jaren geleden ingevoerd.

Vastgoedaandelentransacties

Op dit moment kan het overdragen van nieuwe onroerende zaken middels een aandelentransactie vrijgesteld van omzet- en overdrachtsbelasting plaatsvinden. Het overdragen van dezelfde onroerende zaak middels een stenentransactie is in beginsel wel belast met omzet- en/of overdrachtsbelasting.

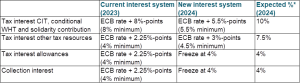

Om deze ongelijke behandeling op te heffen en belastingbesparing via deze route af te snijden, wordt voorgesteld om de samenloopvrijstelling in de overdrachtsbelasting gedeeltelijk af te schaffen voor aandelentransacties. De vrijstelling is per 1 januari 2025 alleen nog van toepassing als de betreffende onroerende zaak in de twee jaar na de transactie voor tenminste 90% voor btw belaste prestaties wordt gebruikt. Indien de onroerende zaak voor <90% voor btw belaste prestaties wordt gebruikt, is overdrachtsbelasting verschuldigd. Hiervoor wordt een nieuw tarief van 4% geïntroduceerd.

Het wetsvoorstel loopt mee met Belastingplan 2024, maar zal pas per 1 januari 2025 in werking treden. Voor lopende transacties wordt voorzien in overgangsrecht. Transacties die onder het overgangsrecht vallen kunnen nog plaatsvinden op basis van de huidige regeling. De volgende voorwaarden zijn van toepassing op het overgangsrecht:

- partijen (koper/verkoper) moeten vóór 19 september 2023, 15:15 uur, een schriftelijke intentieovereenkomst hebben gesloten. In de intentieovereenkomst moet onder andere staat op welk project de overeenkomst van toepassing is en onder welke voorwaarden en binnen welke termijn het project / de aandelenoverdracht wordt gerealiseerd.

- voor 1 april 2024 dienen partijen een verzoek tot toepassing van het overgangsrecht in bij de Belastingdienst;

- het moet aannemelijk zijn dat de intentieovereenkomst niet hoofdzakelijk is gesloten om gebruik te kunnen maken van dit overgangsrecht.

Het overgangsrecht vervalt per 1 januari 2030. Transacties die na die datum plaatsvinden vallen per definitie onder de nieuwe regeling.

Box 3

Voorgesteld wordt om de volgende wijzigingen door te voeren in Box 3:

- Het tarief wordt verhoogd naar 34% per 2024.

- Het heffingsvrijevermogen wordt bij wijze van uitzondering niet geïndexeerd en blijft in 2024 gehandhaafd op € 57.000 per belastingplichtige.

- Onderlinge vorderingen en schulden tussen partners en ouders en minderjarige kinderen worden genegeerd.

- Aandelen in VvE-vermogen en geld op derdenrekeningen worden per 2024 aangemerkt als banktegoeden, waardoor het lagere forfait van toepassing is.

Voorgesteld wordt om de onder 3) en 4) genoemde aanpassingen met terugwerkende kracht vanaf 1 januari 2023 van toepassing te laten zijn.

Overigens merken wij op dat heffing in Box 3 op dit moment plaatsvindt op basis van tijdelijke wetgeving (‘Overbruggingswet box 3’). De houdbaarheid van deze wetgeving c.q. de heffingssystematiek is juridisch discutabel en onderwerp van diverse procedures. Op maandag 18 september 2023 is de huidige regelgeving fel bekritiseerd door advocaat-generaal (A-G) Wattel. Volgens de A-G schendt de wet het discriminatieverbod en het eigendomsrecht.. De conclusie van de A-G is een advies aan de Hoge Raad, die over ongeveer zes maanden uitspraak zal doen in een Box 3-procedure. Tot die tijd is het advies om in kaart te (laten) brengen of het zinvol is om bezwaar te maken.

Aangekondigde voorstellen die geen onderdeel uitmaken van het Belastingplan 2024

Afgelopen jaar zijn diverse fiscale maatregelen aangekondigd, onder andere in de voorjaarsnota. Niet alle voorstellen zijn opgenomen in het belastingplan 2024. Dit betreft onder andere de volgende maatregelen:

- Aanpassing btw-herziening op ‘kostbare diensten’ (ter bestrijding van shortstaystructuren).

- Aanscherping voorwaarden splitsingsvrijstelling voor de overdrachtsbelasting.

- Beperking rente-aftrek voor vastgoedverhuurders.

Mogelijk worden deze maatregelen alsnog opgenomen in het belastingplan 2025. Het politieke landschap zal hiervoor bepalend zijn.