It has become clear now that in all sectors corporate taxpayers will be adversely affected by the Corona pandemic. It affects the global economy and companies face disruptions to their supply chains, which subsequently results in eroding profit margins. Multinational enterprises (MNE’s) are likely to see increased scrutiny by local tax authorities in the post-pandemic period, like following the 2008 financial crisis.

In order to develop a contemporaneous audit defense file, MNE’s must assess the potential impact and document as much as possible the transfer pricing positions taken during the pandemic. In this article we will provide an overview of the following attention areas: substance, permanent establishments, TP methods and benchmarks and agreements.

Substance

Accelerated by the BEPS project there is an increased focus on substance of companies. Due to the current travel bans and restrictions it is not always possible for board members to physically join board meetings. This may raise concerns about a potential change in the “place of effective management” of a company as a result of a relocation, or inability to travel, of chief executive officers or other senior executives. The OECD recently issued practical guidance on the tax consequences of the economic crisis titled ‘Secretariat Analysis of Tax Treaties and the Impact of the COVID-19 Crisis’. The OECD clarifies that it is unlikely that the crisis will create any changes to an entity’s residence status under a tax treaty. A temporary change in location of the board members and other senior executives is an extraordinary and temporary situation due to the crisis and such change of location should not trigger a change in residency, especially once the tie breaker rule contained in tax treaties is applied. Though taxpayers should still proceed with caution till the national governments have explicitly endorsed the OECD’s viewpoint. One needs to be aware, in the preparation of online board meetings, on its possible effect on the tax residency if this modus operandi progressively might not be considered incidental.

Permanent establishments and representatives

Another consequence of working from home could be triggering a foreign tax liability by having a permanent establishment (PE) or permanent representative (PR). One should be careful that the home office is not considered a PE. The guidance of the OECD on dealing with the economic crisis stated that this should not occur since a PE requires a certain degree of continuity and is not triggered by temporary measures in order to prevent an unnecessary fragmentation of the taxable income. The OECD further explicates that a home office should only be relevant if it is clear that the employer has requested the employee to constantly work from home (e.g., by not providing office space). A government intervention should not be viewed as such. Once again, one should await explicit confirmation by national governments of this viewpoint.

Transfer pricing methods and benchmarking

Many business models and international operating groups entail a single or centralized entrepreneur with low risk operating companies throughout the world, like toll manufacturers, limited risk distributors (LRD’s) and other intra group service providers. These subsidiaries with routine functions are normally considered the least complex entities and will therefore be the tested party in the benchmark analysis. In most cases these routine functions are expected to earn a relatively small but stable profit margin on a TNMM (Transactional Net Margin Method) or Cost Plus basis. Allocating losses to these routine functions is in normal circumstances highly unusual. However, this margin applies to regular business circumstances. Although LRD and toll manufacturer risks are limited, they still bear local market risks.

With regards to the transfer pricing method utilized, a distinction should be made between a TNMM, which is a net return on sales, costs or assets and categorically should not lead to a loss position, and the cost-plus method that is gross margin based. Groups suffering losses due to the pandemic should consider whether transfer pricing adjustments are required to ensure that these entities with routine functions continue to receive reasonable profits, while the principal could obtain the residual profits (or losses). Or potentially there are reasons for which the low risk entities can partly share in the losses of the group.

Since the arm’s length range is based on a comparison with historic third-party transactions, with completely different market conditions than the current economic conditions, it may be a reasonable approach to consider that the standard range does not completely reflect the current economic conditions. As a result, a lower point in the quartile range could be applied. This interquartile range of an arm’s length pricing is derived from benchmark analyses of comparable companies. Typically, this range is a three-years weighted average of the comparable profit margins. It may be necessary to rely on a single or multi-year range to adjust to the economic downturn.

Considering that the current intercompany transaction pricing may deviate from the interquartile range, it should be further discussed whether the losses of subsidiaries with routine functions, which are generated due to insufficient productivity and a slacking market demand resulting from a force majeure type of event, could trigger the termination of these intra group contracts. It could also be a reason to further update these agreements to make them more like third party contracts.

Therefore, it is essential for those companies impacted by these extraordinary circumstances, that the business impact is quantified and well documented to support the argumentation towards tax authorities of deviations between initial budgets and actual margins per entity. MNE’s should consider to amend their intercompany agreements as a consequence of the economic downturn, to support a deviation within or from the arm’s length range. This will the support the position to use a lower point in the companies’ current standard range.

The effect of government assistance

The OECD transfer pricing guidelines stipulates that there are some circumstances in which a taxpayer will consider that an arm’s length price should be adjusted to account for government interventions such as quarantines and travel bans, we currently face. As a general rule, these government interventions should be treated as conditions of the market and in the ordinary course they should be taken into account in evaluating the taxpayer’s transfer price in that market.

Various countries decided to support and subsidies companies during the pandemic crisis. It is clear from practical experience that, particularly in situations in which the cost-plus method is used for determining an arm’s length price, the question arises whether government assistance benefits should be deducted from the cost base. National tax administrations should clarify if and under what conditions, these specific emergency reimbursements can be deducted from the cost basis.

Transfer pricing documentation and APA’s

In these difficult times having in place robust and contemporaneous documentation to ensure that you have considered the local transfer pricing requirements is more important than ever. This provides the tax authorities with the necessary information to conduct an audit and mitigates the tax risk of MNE’s.

The group should prepare corresponding transfer pricing documentation to explain which party should bear the losses or quantify the losses caused by the epidemic.

APA’s allow the taxpayer and tax authority advance certainty with respect to the at arm’s length prices to be applied. In the current crisis it is time to reconsider if the underlying assumptions still are met. Potentially the APA could be terminated if the assumptions are no longer met and not addressed. MNE’s that have entered advanced pricing agreements (APA’ s) should discuss with the local tax authorities if the impact of these extraordinary circumstances will lead to the agreement being invalidated or financials adjustments can be made in consultation with the tax authorities.

Reconsider financing structure

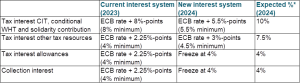

As a result of the pandemic outbreak MNE’s may be in more need of funds for the continuity of the business. The drastic changes in the market could trigger clauses in financing arrangements for collateral or the maximum level of debt to equity of the borrower. Companies may avail themselves to meet their financial obligations through (implicit) guarantees by the parent company. Under the new guidance on financial transactions, issued by the OECD in February 2020, it may be reasonable to renegotiate financial arrangements to more favorable terms, delay interest payments on a temporary basis, or re-characterize short-term loans as long-term loans.

As an immediate response companies that are facing difficult circumstances due to the pandemic should reconsider their intercompany financing through the following:

- Re-examine financing structure to ensure the entities are properly capitalized, given revised budgets;

- Consider conversion of debt into equity or re-financing. Refinancing may be a good idea in the event a quick turnaround is expected, as favorable (assuming credit rating deterioration) interest deduction will be available once profits will be back.

Practical way forward

A lot is coming to taxpayers and transfer pricing may not be the top priority at this time. However, the choices you make today have an impact in the future and can be questioned. Therefore, these choices need to be carefully considered and documented. Taxpayers should anticipate and review their transfer pricing models, if needed amend intercompany agreements and substantiate the positions taken and amendments implemented through proper documentation.

Tax authorities will focus on reviewing transfer pricing policies and outcomes for historical tax years affected by the Corona pandemic and try to distinguish between the economic effects of the pandemic versus normal market risk as a result of business conduct. As stressed above, MNE’s should document how and the extent to which business is distorted due to the pandemic outbreak and how impacted the profitability of group companies.

A transfer pricing analysis should be made substantiating why certain group companies might end up with a profitability lower than expected and the impact of changes in intercompany financing to improve cashflow. Past benchmark studies based on financials of past years are likely not appropriate.

With regards to PE risks we do not expect an immediate risk given that incidental working from home or travel restrictions of the workforce should not lead to a PE.

More information?

If you would like more information, please contact Jimmie van der Zwaan or Berend van Holthuijsen.