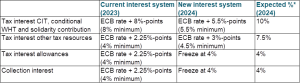

On Budget Day 2024, the State Secretaries of Finance informed the House of Representatives of the proposed changes to the interest rates on interest on underpaid tax (tax interest) and interest on overdue tax (collection interest).

The new proposed system for determining the tax interest rates will be implemented per 1 January 2024. The aim of the new system is to reduce the difference between the tax interest rates for corporate income tax (“CIT”) and conditional withholding taxes (“conditional WHT”), on the one hand, and tax interest rates for other tax resources (such as dividend withholding tax, VAT, wage tax, real estate transfer tax and personal income tax), on the other hand. The interest rates will henceforth be set once a year, based on the latest ECB interest rate published before 31 October of that year and take effect as of 1 January of the following year (i.e., for the first time on 1 January 2024).

Tax interest rate for CIT, conditional withholding tax and solidarity contribution

The tax interest rate is currently frozen at 8%. Under the proposed system, the tax rate for CIT, conditional WHT and solidarity contribution will be set at the ECB rate for main refinancing operations plus 5.5 percentage points, rounded to half percentage points and with a minimum of 5.5%. The expected rate as of 1 January 2024 is 10%.

Tax interest rate for other tax resources

The interest tax rate for other tax resources (including dividend withholding tax, VAT, wage tax, real estate transfer tax and individual income tax) will be set at the ECB rate for main refinancing operations plus 3 percentage points, rounded to half percentage points and with a minimum of 4.5%. The expected rate as of 1 January 2024 is 7.5%. The interest tax percentage increased from 4% to 6% as of 1 July 2023.

Tax interest on allowances

The intention is to loosen the link between the statutory interest rate for other tax resources and the interest rate for surcharges. As of 1 January 2024, the rate for surcharges will then be frozen at 4%.

Recovery interest system

Recovery or collection interest (interest on overdue tax) for all tax resources and allowances will be frozen at 4% as of 1 January 2024. This has been chosen for the time being for implementation reasons. It is still being considered how collection interest can also be redesigned – by a subsequent Cabinet.

Taxand’s take

The final tax interest rates will not be known until the European Central Bank re-sets the ECB interest rate on 31 October 2023. However, it is expected that the tax interest rates will rise significantly and a small amount of additional income has been budgeted. Therefore, we would like to stress the importance of timely filing a (preliminary) tax return or otherwise requesting for a(n) (preliminary) assessment in order to minimize tax interest. Please contact your trusted Taxand Netherlands advisor for assistance or advise.

***